- The Fahey Property consists of 360 acres, covered by 18, unpatented US lode claims, situated directly in the strategic center of the Silver Belt portion of the Coeur d’ Alene Mining District, one of the top known producing silver regions in the world where the Idaho State University (2006) estimated 1.18 billion ounces of silver has been produced.

- It is estimated by the Idaho State Historical Society that about 686 million ounces of Idaho State's total silver production (up to 1964), or half of all silver produced, came from the Coeur d'Alene district.

- The Fahey Property is the last property within the Silver Belt that has remained largely unexplored despite its strategic prime location and has been one of the desired properties to be acquired and explored for many years.

- The Fahey Property has been owned by same family for over 60 years, and this will represent for the first time the Property has been available for exploration with modern exploration.

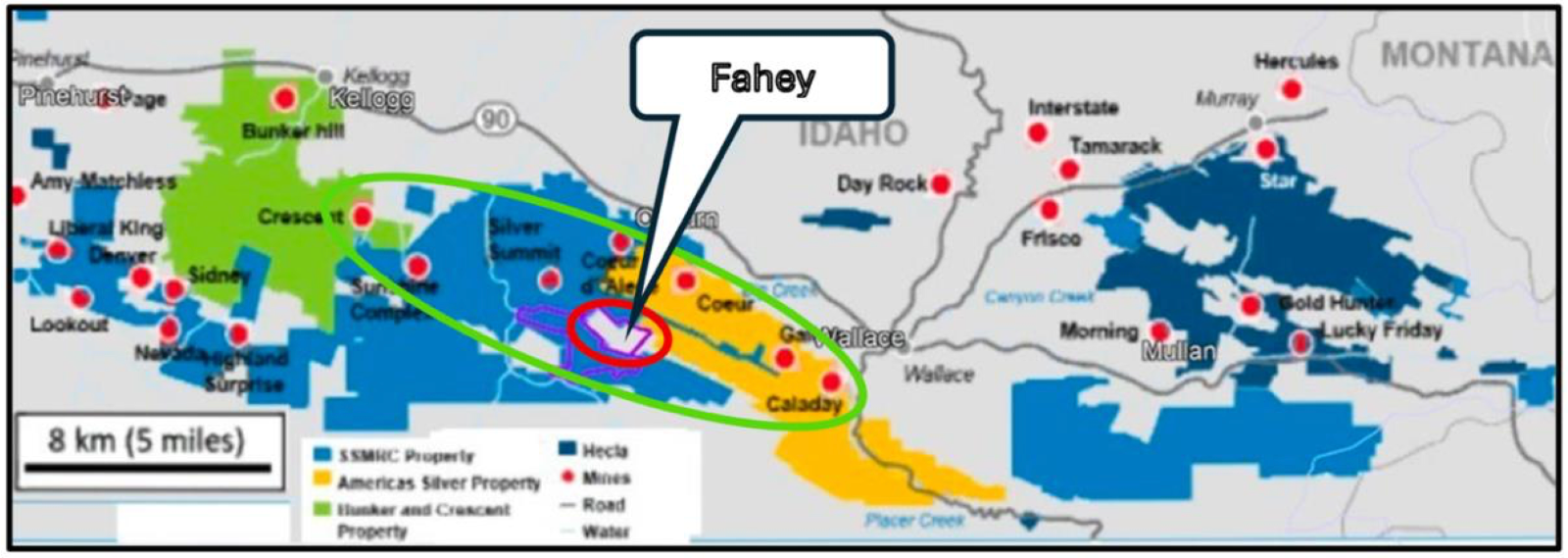

- The Fahey Property is ideally situated between two of the well-known silver mines in North America: the currently operating Galena Mine and the historic Sunshine Mine.

- The Fahey Property occupies a strategic position between property owned by “Sunshine Silver Mining and Refining” and “Americas Gold and Silver”.

- The Fahey Property is underlain by the same favorable Revett Formation quartzite.

- The Sunshine land position surrounds the Fahey Group on three sides, which includes the multi-million ounces silver producers notably the Sunshine Mine, the Silver Summitt Mine and the Polaris Mine.

- The Americas Silver and Gold land position borders the Fahey Property to the East, which includes the operating Galena Mine and has produced million ounces of silver, along with the Coeur Mine and the Mineral Point Mine.

- More than 20 veins have been identified within the Fahey Property, which is more than the number of veins in either the Bunker Hill Mine (the largest mine in the district) or the Sunshine mine, with the greatest silver production in the Coeur d’Alene mining district.

Fahey Group, Idaho Silver Valley

Project Overview

Transaction Overview to Acquire 100%

Under the terms of the Option Agreement, the Company may earn a 100% interest in the Property, free and clear of all encumbrances other than a retained royalty, by paying Fahey US$50,000 in cash and issuing C$450,000 worth of common shares of the Company (“Consideration Shares”), to be satisfied as follows: US$25,000 in cash within three (3) business days of the effective date of the Option Agreement; US$25,000 in cash on or before June 30, 2026; C$50,000 in Consideration Shares on or before December 31, 2026; C$75,000 in Consideration Shares on or before December 31, 2027; C$75,000 in Consideration Shares on or before December 31, 2028; C$125,000 in Consideration Shares on or before December 31, 2029; and C$125,000 in Consideration Shares on or before December 31, 2030.

In addition, the Company must incur an aggregate of at least C$1,500,000 in exploration expenditures on the Property, consisting of a minimum of C$200,000 on or before December 31, 2027 and a further C$1,300,000 on or before December 31, 2030, with any excess expenditures from earlier periods credited toward later commitments.

The Company may extend the deadline for the final share payment due December 31, 2030, as well as the exploration expenditure deadline of December 31, 2030, by one (1) year through the issuance of C$50,000 worth of Consideration Shares. The Company may also accelerate any cash payments, share issuances, or exploration expenditures at its sole discretion without penalty.

All Consideration Shares issued under the Option Agreement will be priced at the volume-weighted average trading price of the Company’s shares on the Canadian Securities Exchange (the “CSE”) for the twenty (20) trading days prior to issuance, subject to the CSE’s minimum pricing requirements. If the deemed price is less than C$0.05 or otherwise not permitted under CSE policies and results in the aggregate value of the Consideration Shares issued being less than the stated dollar amount of the applicable installment, the Company will pay the shortfall to Fahey in cash (converted to equivalent value in US$) within sixty (60) days of the applicable issuance date. The Company will also have the option to make any payments in cash (converted to equivalent value in US$) in lieu of issuing Consideration Shares.

Upon exercise of the Option, the Company will grant Fahey a 2.0% net smelter returns royalty (the “Royalty”) on the Property, which may be reduced by 0.5% (to 1.5%) upon payment of US$1,000,000 to Fahey.

Following exercise of the Option, upon the commencement of commercial production at the Property, the Company will also make a milestone payment of US$1,500,000 to Fahey, payable in cash, shares, or any combination thereof, at the Company’s discretion, within thirty (30) days of achieving commercial production.

Fahey Group Claim Outline